Compensation

We offer a competitive salary based on your experience, education, and role fit, with opportunities for performance-based pay.

- Starting salary: reflects your background and market/internal equity.

- Salary growth: may include market adjustments, service-based increases, and merit-based bonuses.

Benefits

Eligibility and Coverage

Your benefit eligibility depends on job status and length of your current appointment (not cumulative).

- Appointments under six months may qualify for part-time benefits after a waiting period.

- You and your dependents must live in Canada and be covered under a provincial health plan.

- Coverage start dates vary by benefit.

Below are the highlights of benefit plans for each employee group:

You may be eligible if you are an ASPA member working at least halftime (0.5 FTE) and are actively employed as one of the following:

- a permanent or seasonal employee, or

- a permanent or seasonal employee who is temporarily occupying a term position, or

- a term employee with an appointment of six months or longer

| Plan | Overview |

|---|---|

| Dental Eligibility: All appointments 6 months or longer |

Dental Services: 100% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement for children under 19, lifetime max $2,000/child. |

| Health and Drug Eligibility: All appointments 6 months or longer |

Prescription Drugs: 100% reimbursement, max $2,000/year, generic drugs. Vision Care: 100% reimbursement, $150 for eye exams, $300 for eyewear or laser surgery (resets every two years). Paramedical*: 100% reimbursement, max $350/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 100% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Flexible Spending Eligibility: All appointments 6 months or longer |

Annual Contribution: $900. Allocation Options: Health Spending Account and/or Personal Spending Account. |

| Life Insurance Eligibility: All appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 1 year or more, or permanent/seasonal |

Short-Term Disability: 112 days full salary continuance, ends at age 67. Long-Term Disability: 66 2/3% of salary, max $7,500/month, Cost of Living Adjustment up to 2%, ends at age 65. |

| Pension Eligibility: Appointments over 6 months, or permanent/seasonal |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

- Dental and Basic Life: after 3 months

- Health and Drug: on hire date (or return if absent)

- Flexible Spending: with Health Plan enrollment

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: on hire date

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans, and the Health Spending Account

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: Special Lecturers in a term longer than 4 months, and all other appointments 6 months or longer |

Dental Services: 100% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement, lifetime max $3,000 if under age 19, or $2,000 if age 19 or older. |

| Health and Drug Eligibility: Special Lecturers in a term longer than 4 months, and all other appointments 6 months or longer. |

Prescription Drugs: 100% reimbursement, max $5,000/year, generic drugs. Vision Care: 100% reimbursement, $150 for eye exams, $400 for eyewear or laser surgery (resets every two years). Paramedical*: 100% reimbursement, max $500/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 100% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Flexible Spending Eligibility: All appointments 6 months or longer |

Annual Contribution: $500. Allocation Options: Health Spending Account and/or Personal Spending Account. |

| Life Insurance Eligibility: All appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent |

Short-Term Disability: 112 days full salary continuance. Long-Term Disability: 70% of salary, max $11,841.67/month, Cost of Living Adjustment up to 3.5%. Both benefits end June 30th on or after age 67. |

| Post Retirement Spending Account Eligibility: Age 55+ and 10+ years of service |

$2,000/year for 2 years post-retirement to reimburse private health/dental premiums |

| Pension Eligibility: Appointments over 6 months |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

Effective date of coverage:

- Health/Drug/Dental/Basic Life: on your first day at work

- Flexible Spending: with Health Plan enrollment

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: after 6 months

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans, and the Health Spending Account

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: Special Lecturers in a term longer than 4 months, and all other appointments 6 months or longer |

Dental Services: 100% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement, lifetime max $3,000 if under age 19, or $2,000 if age 19 or older. |

| Health and Drug Eligibility: Special Lecturers in a term longer than 4 months, and all other appointments 6 months or longer. |

Prescription Drugs: 100% reimbursement, max $5,000/year, generic drugs. Vision Care: 100% reimbursement, $150 for eye exams, $400 for eyewear or laser surgery (resets every two years). Paramedical*: 100% reimbursement, max $500/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 100% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Life Insurance Eligibility: All appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent/seasonal |

Short-Term Disability: 112 days full salary continuance. Long-Term Disability: 70% of salary, max $11,841.67/month, Cost of Living Adjustment up to 3.5%. Both benefits end June 30th on or after age 67. |

| Pension Eligibility: Appointments over 6 months |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

Effective date of coverage:

- Health/Drug/Dental/Basic Life: on your first day at work

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: after 6 months

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: All appointments 6 months or longer |

Dental Services: 100% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement for children under 19, lifetime max $2,000/child. |

| Health and Drug Eligibility: All appointments 6 months or longer |

Prescription Drugs: 100% reimbursement, max $2,000/year, generic drugs. Vision Care: 100% reimbursement, $150 for eye exams, $300 for eyewear or laser surgery (resets every two years). Paramedical*: 100% reimbursement, max $350/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 100% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Flexible Spending Eligibility: All appointments 6 months or longer |

Annual Contribution: $500. Allocation Options: Health Spending Account and/or Personal Spending Account. |

| Life Insurance Eligibility: All appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent/seasonal |

Short-Term Disability: 112 days, 66 2/3% of pre-disability earnings, ends at age 65. Long-Term Disability: 60% of pre-disability earnings, max $4000/month, Cost of Living Adjustment up to 2%, ends at age 65. |

| Pension Eligibility: Appointments over 6 months, or permanent/seasonal |

Participation in the CAAT DBplus Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

Effective date of coverage:

- Health/Drug: on your first day at work

- Dental/Basic Life - after 3 months of continuous employment

- Flexible Spending: with Health Plan enrollment

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: after 6 months

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans, and the Health Spending Account

- You are eligible for benefits, unless you are a member of another university benefit plan.

| Formulary Drug Coverage |

100% reimbursement, max 2,000/year*, generic drugs. |

| Dental Plan | 100% reimbursement for basic services, max $2,000/year* (member only). |

| Life Insurance | Basic Life: $30,000. Business Travel Accident Insurance: provided. |

*Annual maximums apply to coverage regardless of number of terms/classes taught in a one plan year.

Effective date of coverage:

- There are no waiting periods for any benefits and will take effect and terminate on the dates set out in your offer letter.

Eligible dependents are eligible for Formulary Drug Coverage.

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: Appointments 6 months or longer |

Dental Services: 90% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement for children under age 19, lifetime max $2,000. |

| Health and Drug Eligibility: Appointments 6 months or longer. |

Prescription Drugs: 90% reimbursement, max $2,000/year, generic drugs. Vision Care: 90% reimbursement, $150 for eye exams, $300 for eyewear or laser surgery (resets every two years). Paramedical*: 90% reimbursement, max $350/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 90% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Flexible Spending Eligibility: Appointments 6 months or longer |

Annual Contribution: $1,000. Allocation Options: Health Spending Account and/or Personal Spending Account and/or Tuition Spending Account |

| Life Insurance Eligibility: Appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent |

Short-Term Disability: 112 days full salary continuance, ends at age 65. Long-Term Disability: 66 2/3% of salary, max $7,500/month, Cost of Living Adjustment up to 2%, ends at age 65. |

| Post Retirement Spending Account Eligibility: Age 55+ and 10+ years of service |

$1,000/year for 2 years post-retirement (intended to reimburse private health/dental premiums) . |

| Pension Eligibility: Appointments over 6 months |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

Effective date of coverage:

- Health/Drug: on your first day at work

- Dental/Basic Life: 3 months after continuous employment

- Flexible Spending: with Health Plan enrollment

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: after 6 months

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans, and the Health Spending Account

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

| Plan | Overview |

|---|---|

| Dental Eligibility: Term 6 months or longer |

Dental Services: 70% reimbursement for basic services, 50% for major services, combined max $2,000/year. |

| Health and Drug Eligibility: Term 6 months or longer. |

Prescription Drugs: 70% reimbursement, max $2,000/year, generic drugs. Vision Care: 70% reimbursement, $100 for eye exams, $400 for eyewear or laser surgery (resets every two years). Paramedical*: 70% reimbursement, max $350/year per practitioner. Medical: 70% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Life Insurance Eligibility: Term 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Business Travel Accident Insurance: provided. |

*Paramedical: acupuncturist, chiropractor, chiropodist/podiatrist, naturopath, osteopath, psychologist/social worker, physiotherapist, registered massage therapist, speech therapist

Effective date of coverage:

- Health/Drug: on your first day at work

- Dental/Basic Life: 3 months after continuous employment

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans

You may be eligible if you are:

- Working at least halftime (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: Appointments 6 months or longer |

Dental Services: 100% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement, lifetime max $3,000 if under age 19, or $2,000 if age 19 or older. |

| Health and Drug Eligibility: Appointments 6 months or longer |

Prescription Drugs: 100% reimbursement, max $5,000/year, generic drugs. Vision Care: 100% reimbursement, $150 for eye exams, $400 for eyewear or laser surgery (resets every two years). Paramedical*: 100% reimbursement, max $500/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 100% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Life Insurance Eligibility: Appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent/seasonal |

Short-Term Disability: 112 days full salary continuance. Long-Term Disability: 70% of salary, max $11,841.67/month, Cost of Living Adjustment up to 3.5%. Both benefits end June 30th on or after age 67. |

| Pension Eligibility: Appointments over 6 months, or permanent/seasonal |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

- Health/Drug, Dental and Basic Life: first day of work

- Optional Life: upon insurer approval

- Optional AD&D: upon application

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans

You may be eligible if you are:

- Working at least halftime (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms

| Plan | Overview |

|---|---|

| Dental Eligibility: Appointments 6 months or longer |

Dental Services: 90% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement for children under 19, lifetime max $2,000/child. |

| Health and Drug Eligibility: Appointments 6 months or longer |

Prescription Drugs: 90% reimbursement, max $2,000/year, generic drugs. Vision Care: 90% reimbursement, $150 for eye exams, $300 for eyewear or laser surgery (resets every two years). Paramedical*: 90% reimbursement, max $350/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 90% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Life Insurance Eligibility: Appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent/seasonal |

Short-Term Disability: 112 days full salary continuance, ends at age 65. Long-Term Disability: 66 2/3% of salary, max $7,500/month, Cost of Living Adjustment up to 2%, ends at age 65. |

| Pension Eligibility: Appointments over 6 months, or permanent/seasonal |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

- Health/Drug: first day of work

- Dental/Basic Life: 3 month waiting period

- Optional Life: upon insurer approval

- Optional AD&D: upon application

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans

You may be eligible for benefits if you:

- Work at least half-time (0.5 FTE)

- Have a current appointment that meets eligibility requirements (eligibility is based on each individual appointment and is not cumulative across terms)

| Plan | Overview |

|---|---|

| Dental Eligibility: Appointments 6 months or longer |

Dental Services: 90% reimbursement for basic services, 50% for major services, combined max $2,000/year. Orthodontic Services: 50% reimbursement, lifetime max $3,000 if under age 19, or $2,000 if age 19 or older. |

| Health and Drug Eligibility: Appointments 6 months or longer |

Prescription Drugs: 90% reimbursement, max $5,000/year, generic drugs. Vision Care: 90% reimbursement, $150 for eye exams, $400 for eyewear or laser surgery (resets every two years). Paramedical*: 90% reimbursement, max $500/year per practitioner for physical wellness, $2,000/year combined max for mental health. Medical: 90% reimbursement for equipment, services, supplies (unlimited unless defined otherwise). Travel: 100% for emergencies, 80% for referred services, lifetime max $3,000,000 (out-of-country emergency only; within Canada, provincial health is first payer). |

| Flexible Spending Eligibility: Appointments 6 months or longer |

Annual Contribution: $1,200. Allocation Options: Health Spending Account and/or Personal Spending Account and/or Tuition Spending Account |

| Life Insurance Eligibility: Appointments 6 months or longer |

Basic Life: 2x annual earnings, max $500,000. Optional Life and/or Accidental Death and Dismemberment (AD&D): Available for employees and spouses, max $500,000 per person per benefit. Business Travel Accident Insurance: provided. |

| Disability Eligibility: Appointments 2 years or more, or permanent |

Short-Term Disability: 112 days full salary continuance, ends at age 65. Long-Term Disability: 70% of salary, max $250,000/year, Cost of Living Adjustment up to 2.5%, ends at age 65. |

| Post Retirement Spending Account Eligibility: Age 55+ and 10+ years of service |

$2,000/year for 2 years post-retirement (intended to reimburse private health/dental premiums). |

| Pension Eligibility: Appointments over 6 months |

Participation in the Academic Money Purchase Pension Plan. |

*Paramedical Services

Physical Wellness: acupuncturist, chiropodist/podiatrist, chiropractor, naturopath, osteopath, physiotherapist, registered massage therapist, speech therapist

Mental Health: clinical counsellors, marriage and family therapist, psychologist, psychotherapist, social worker

Effective date of coverage:

- Health/Drug/Dental/Basic Life: on your first day at work

- Flexible Spending: with Health Plan enrollment

- Optional Life: upon insurer approval

- Optional AD&D: upon application

- Pension: after 6 months

Eligible dependents are eligible for coverage under your Health/Drug and Dental plans, and the Health Spending Account

- You may be eligible if you do not qualify for full-time benefits, work 390 hours during the initial qualifying period of 26 consecutive weeks following date of hire, or 780 hours in a 12-month period.

| Formulary Drug Coverage |

100% reimbursement, max 2,000/year, generic drugs |

| Dental Plan | 100% reimbursement for basic services, max $2,000/year (member only) |

| Life Insurance | Basic Life: 2x annual earnings, max $500,000. Business Travel Accident Insurance: provided. |

| Pension Eligibility: Employed continuously for 24 months and earned at least 35% of the Year’s Maximum Pensionable Earnings in each of the past 2 calendar years |

Part-time pension benefits applicable to your employee group |

Effective date of coverage:

- 26 consecutive weeks of employment from your date of hire

Eligible dependents are eligible for Formulary Drug Coverage.

Pension

We offer new employees enrolment in one of our Defined Contribution (DC) Pension Plans or Defined Benefit (DB) Pension Plans.

Pension Plan Highlights

Qualifying salaried full-time or part-time employees (0.5 FTE or greater):

- Participation in one of these two plans is mandatory if you have an appointment of greater than 6 months

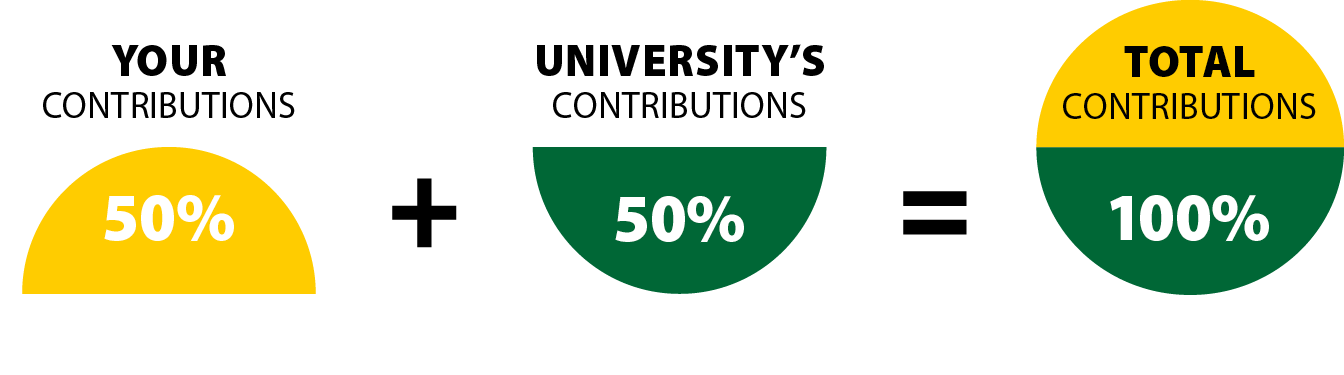

Contributions

The pension plan makes it simple to save for retirement. Your contributions are automatically deducted from each pay and you also get the benefit of an equal contribution from the University.

How much will you and the University put in? It all depends on your position.

| Position | Your contribution | University’s contribution | Total contribution amount per year |

|---|---|---|---|

|

Senior Administrative and academic or equivalent employees |

8.5%

|

8.5%

|

17.0%

|

|

Administrative and part-time research support employees |

7.0%

|

7.0%

|

14.0%

|

|

Canadian Light Source Employees Unifor Local 609 |

8.0%

|

8.0%

|

16.0%

|

Contributions are a percentage of your pensionable earnings, which include your regular salary but exclude items such as honorariums, fees, and summer session payments. Pensionable earnings are subject to an annual maximum.

The total of your contributions and the University’s contributions cannot exceed the limit set by CRA each year. For more details, please visit www.canada.ca.

Qualifying permanent, seasonal, or term CUPE 1975 employees (0.5 FTE or greater):

- Participation is mandatory if you have an appointment of greater than 6 months

The CAAT Pension Plan is a multi-employer defined benefit pension plan that offers a secure pension to its members. It is independent of the University of Saskatchewan.

Contributions

When you become a member, contributions will be deducted from your earnings and matched by the University of Saskatchewan dollar for dollar.

| Position | Employee contributions | USask contributions | Total contribution amount per year |

|---|---|---|---|

| CUPE 1975 |

7.5%

|

7.5%

|

15.0%

|

Development and Well-Being

Whether you're interested to pursue further education, seek a better work-life balance, or growing a family, USask offers a variety of opportunities to support you.

Tuition Waiver

Eligible employees may take classes with tuition waived or reimbursed.

Professional Expense Fund

Eligible faculty and staff receive annual funding to help pay for activities that will enhance your work performance, ability or effectiveness.

Training and Development

USask workshops and programs are available to support training and development.

Wellness Supports

Our wellness strategy guides our resources and services that promote a safe, healthy, work-life balance.

Employee and Family Assistance Program

Offers free, confidential, 24/7 support for university faculty, staff, and their families - including short-term counselling, work-life solutions, legal and financial guidance, health coaching, and crisis intervention services.

Additional options may be available to you. Please refer to employment agreements for full details, as eligibility varies by employee group.

Perks

As a USask employee, you’ll enjoy access to exclusive perks and on-campus amenities:

Campus Convenience

Enjoy a range of on-campus amenities designed to support your daily life including:

Fitness Facilities

Our Physical Activity Complex is a state of the art fitness facility that caters largely to students, faculty, and staff.

Campus Daycare

Licensed childcare for ages 2.5–6. Additional spots may be available through the USSU.

Food Services

Multiple dining options on campus with employee meal plans.

Employee Deals

Take advantage of exclusive discounts and offers available to USask employees including:

Microsoft Advantage

Free Office downloads on up to 5 devices, plus mobile access.

Technology Discounts

USask offers you an education discount on computer products and a discount on cell phones and plans through Telus Mobility where employees can save up to 30%.

Veterinary Services

25% discount at the Veterinary Medical Centre on services, pet food, and prescriptions.

Questions?

Current faculty and staff

Access your benefit information including benefit plans, coverage, eligibility, claims and more in PAWS.